Question

I have an inherited family property that I need to clarify if CGT applicable to and if so, what is the method to use for the CGT calculation.

My initial view was to use the apportionment formula but on reading your CGT & Death & Taxes booklets am hoping for a more favourable CGT outcome using another aspect of CGT law such as market value substitution or ID2005/216 / TD1999/78 with a Deed of Family Arrangement that the family created to maybe exempt house in full.

My client is the daughter.

The timeline in terms of ownership & key events is as follows:

-

25 October 2007 – Purchased by parent (father) for $850,000. It was never the parents PPOR.

- Immediately at settlement the parents’ daughter and her partner move into the home.

- The daughter and her family have lived continuously in the property as their main residence through the time period to this day.

- The father recorded the property on his tax return as an investment property. It was a very old property so no depreciation adjustments to worry about.

- 14 December 2007 – Father creates a will that appoints the daughter and her siblings as substitute executors (if his wife unable to); which also confers discretionary powers to the executors. Wife has reciprocal arrangement on her will.

- 6 June 2013 – The father dies.

- 19 December 2013 – Probate on fathers will granted to wife.

- 2013 Valuation estimate: During the period between 2007 and 2013 the daughter & son-in law do over $400,000 in renovations (at their own cost) to convert the home from a 3 bedroom to a 5-bedroom house. Estimated market value from comparable sales and professional valuer at this time was $1.25m

- October 2013 – The mother develops a serious health condition and so the siblings apply to Supreme Court NSW to be substituted as executors of fathers estate (as per his will).

- 6 March 2018 – The Supreme Court grants the siblings probate jointly.

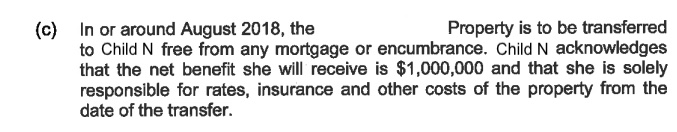

- 1 April 2018 – The siblings enter into a Deed of Family Arrangement to acknowledge these events, and specifically in the recitals of the deed, “that the wish of the parents that they be treated equally and of the father that the primary benefit each of his children was to receive, was assistance for them to acquire a home for them and their families to live in as well as assistance with the private school education of all his grandchildren.”

- 24/04/2018 – Contract signed to transfer property to daughter.

- 23/07/2018 – Mortgage is discharged on the property.

- 20/08/2018 – Title transferred to daughter’s name $0 value; Land titles show description as (Devisee, Beneficiary, Next of Kin)

- 2018 Valuation Estimate: $1.65m

- Current – The couple are considering the sale of this property (est current value $2.0m) and wish to confirm if any CGT liability exists.

Questions

What is the appropriate time period and cost base to use for calculating any CGT?

Option 1) – Look at full ownership period & just apportion the days of mixed use?

- Say sold, 02/11/2021 for $2.0m, ($1.95m clear after sale costs)

- Cost base: $850k+SD $33.7k + $5k legals/adjust + $400k reno = $1.288m

- $1.95m – ($1.288m) = Overall Gain $662k gain

- Assessable Days = is it date father dies(06/06/2013)? = 2,052days or date of contract(24/04/18)? 3,835 days

- Total Ownership Days = 5,123 days

- Assessable Gain = $662k * (3,835/5,123) = $662k*74.8% = $495k gain vs 2,052 days gives $662k*40% = $265k gain

- Property held for greater than 12 months so entitled to general 50% CGT discount would reduce the assessable gain to $247.5k or $132k

Any way to use the ATO rulings you outlined to reduce gain to NIL or better result with market value?

Answer

No matter what your client will not get a reset to market value and they will be deemed to have acquired it when the deceased did. That is unless they are considered to have bought it off the estate.

I think this is the section you need https://www.ato.gov.au/law/view/document?docid=PAC/19970038/118-205

In particular

118-205(3)

Add to the component non-main residence days in the formula the number of days in the period applicable under subsection (2) that the *dwelling was not the main residence of one or more of:(a) an individual who owned the dwelling at the time of the individual ‘ s death; or

(b) an individual who, immediately before the death of an individual referred to in paragraph (a), was the spouse of that individual (except a spouse who was living permanently separately and apart from the individual); or

(c) an individual who had a right to occupy the dwelling under a will; or

(d) an individual to whom an *ownership interest in the dwelling *passed as a beneficiary in, or who *acquired an ownership interest in the dwelling as trustee of, a deceased estate.

It says to me that the property is always covered by your client’s main residence exemption. Though this section may only apply if the father inherited the house rather than purchased it. It is a perfect fix for you client so worth an ATO ruling to be sure.

It does bother me that you say there was a mortgage paid out on the property after the deed of arrangement, I hope your client weren’t the ones to pay it out. I am worried that they will be considered to have purchased the property off the estate. If any cash changes hands and I guess that could be paying off an estate debt they are not receiving the house as a beneficiary so the section above could not apply though your client would be considered to have acquired it at market value at the time it was transferred to them so that is fine for their CGT calculation but will cause problems for the estate, that are not your problem. The deed of arrangement does not seem to be a problem but please make sure that the house was only owned by dad otherwise mum is “selling” her half.

I think Child B (b) taking over the debt is going to cause a problem for the estate but that is not our worry. I also think there maybe a problem with the mother still being alive but allowing the children to have some of the assets she is entitled to but again that is not our worry, it is a problem for the estate’s accountant. It says in the deed of arrangement (b) that Child B’s house has a debt but not that your client’s house has a debt, so are you sure there was a debt when the deed of arrangement was entered into?

There is no mortgage mentioned in (c) yet there is in (b). If she discharged the mortgage we have a possibility that she did technically pay the estate in part for the house. The reason I was concerned about this is if a beneficiary pays anything into the estate in return for an asset (as opposed to just switching around who gets what) then they are considered to have purchased the asset off the estate for market value. Which is a great outcome for your client tax wise but not for the estate and they want to claw back tax from her.

SECTION 128-20 When does an asset pass to a beneficiary?

128-20(1)

A *CGT asset passes to a beneficiary in your estate if the beneficiary becomes the owner of the asset:(a) under your will, or that will as varied by a court order; or

(b) by operation of an intestacy law, or such a law as varied by a court order; or

(c) because it is appropriated to the beneficiary by your legal personal representative in satisfaction of a pecuniary legacy or some other interest or share in your estate; or

(d) under a deed of arrangement if:

(i) the beneficiary entered into the deed to settle a claim to participate in the distribution of your estate; and

(ii) any consideration given by the beneficiary for the asset consisted only of the variation or waiver of a claim to one or more other *CGT assets that formed part of your estate.

(It does not matter whether the asset is transmitted directly to the beneficiary or is transferred to the beneficiary by your *legal personal representative.)

128-20(2)

A *CGT asset does not pass to a beneficiary in your estate if the beneficiary becomes the owner of the asset because your *legal personal representative transfers it under a power of sale.

Still just in case it is not covered by the child’s main residence exemption going forward, say they move somewhere else and keep it as a rental. And assuming they are not considered to have purchased the property off the estate. Then you need to record their cost base. Which in accordance with section 128-15 should just be what Dad’s cost base is at DOD.

If after further investigation you find that you cannot fit into the above then take a look at arguing that the father held the house in bare trust for your client. The ATO have been doing some pretty fancy foot on bare trusts in private rulings. Also in Bosanic’s case and McMillan’s case properties held by spouses were considered held for both members of the couple. The ATO appear to be allowing a more lenient approach to the situation where there is an implied trustee arrangement on a property. Even going as far to extend it beyond bare trusts to more than one beneficiary when it comes to the home someone is living in. Anyway what I am getting to here is if all else above fails I reckon it is worth applying for a private ruling. This could achieve a back dated main residence exemption to the date your client moved in as it was really her home just held in trust for her.

We are working on section 106-50 https://www.ato.gov.au/law/view/document?docid=PAC/19970038/106-50

SECTION 106-50 Absolutely entitled beneficiaries

106-50(1)

For the purposes of this Part and Part 3-3 (about capital gains and losses) and Subdivision 328-C (What is a small business entity), from just after the time you become absolutely entitled to a * CGT asset as against the trustee of a trust (disregarding any legal disability), the asset is treated as being your asset (instead of being an asset of the trust).106-50(2)

This Part, Part 3-3 and Subdivision 328-C apply, from just after the time you become absolutely entitled to a * CGT asset as against the trustee of a trust (disregarding any legal disability), to an act done in

relation to the asset by the trustee as if the act had been done by you (instead of by the trustee).Example:

An individual becomes absolutely entitled to a CGT asset of a trust. The trustee later sells the asset. Any capital gain or loss from the sale is made by the individual, not the trustee.

You want to say the house has always been your client’s house from the day her father purchased it. It is not passing to her from the estate but has always been hers, a gift from her father many years ago. Assets held in trust for someone else do not form part of the estate. No CGT at the time of the gift because it was gifted at the same time as the house was purchased so market value substitute which is the same as the purchase price. You need to look into your client’s circumstances to find supporting evidence but I think the way the house has been used over the whole time of ownership is pretty convincing. Don’t be on the back foot here.

Point out if applicable that she has been paying all rates etc as if it was her own house at least since he died. Which I think is the case. Regarding the time he treated it as an investment property that is not good. How did it appear in the father’s tax return was it negatively geared? Or could we argue she just paid enough “rent” to cover the costs associated with the property that she would have to pay if she owned it. Father just did a break even schedule in his tax return to ensure he was not doing anything wrong. He can charge below market rent to a relative as long as he does not negatively gear. The fact they did those renos really helps your argument that he held it in trust for them right from the start, I would concentrate on that in your ruling. No one in their right mind would spend that much without considering that they really own the property. That is really good I just have trouble reconciling this with the fact he treated it as a rental property in his tax return and did not claim depreciation considering those renos would have qualified. Oh dear there is so much here you need to know about his tax return and how the estate treated the property after he died. Do you have access to these?

Extracts from the will that might help

There are a couple of generous ATO private rulings you might want to read.

- CGT – legal v beneficial interest Facts The parents of the taxpayer wished to purchase a home but could not do so as they were unable to secure a loan and, as a result, a property was purchased in the taxpayer’s name. While the loan was in the taxpayer’s name, the taxpayer did not contribute to any repayments of the loan or financially for the property in any other way. The taxpayer never treated the asset as their property. The taxpayer did not receive rent or claim any deductions for expenses. The taxpayer never lived in the property. The taxpayer did not claim the first homeowner’s grant. The parents treated the property as their main residence. The parents are now deceased and the property is being sold as part of the finalisation of their estates. Question Will the taxpayer have a CGT event A1 arising from the sale of the property by the executor of the parent’s estate? Decision and reasons No. The ATO noted that CGT event A1 occurs when there is a disposal of an ownership interest in a CGT asset. However, the ATO said that CGT event A1 does not occur if there is only a change of legal ownership and not a change of beneficial ownership. The ATO noted that the taxpayer agreed to be the registered legal owner of the property, but did not have any expectation of having any elements of beneficial ownership of the property and that it can be reasonably concluded that at time of change of legal ownership of the property, that is, when the property was sold, the taxpayer will not have a CGT event A1 or any other CGT event occurring when his or her legal ownership ends. COMMENT – while this should be lauded as a common sense outcome, it is not in line with other published views of the ATO on property held in trust for more than one person. A similar outcome was also reached in recently published private binding ruling authorisation number 1051888774731. ATO reference Private Binding Ruling Authorisation Number 1051893408035 w https://www.ato.gov.au/law/view/document?docid=EV/1051893408035

- CGT – legal v beneficial interest Facts The taxpayer purchased a property together with their child. The child was unable to obtain finance without the taxpayer being included on the finance and title of the property. The property was always the child’s main residence. The taxpayer never made any repayments to the loan or contributed any way financially to the purchase or upkeep of the property. The taxpayer never treated the property as their asset and did not receive rent or claim any deductions for expenses associated with the property. The taxpayer did not claim any first homeowners grant for the purchase of this property. The taxpayer now wishes to remove his or her name from the title and the loan. No consideration will be paid. Question Will CGT event A1, or another CGT event, happen when the taxpayer removes his or her name from the title of the property? Decision and reasons No. The ATO noted that CGT event A1 occurs when there is a disposal of an ownership interest in a CGT asset but that it does not happen if there is only a change of legal ownership and not a change of beneficial ownership. The ATO accepted that, while the taxpayer was the registered legal owner of the property, there was never any expectation of having any elements of beneficial ownership of the property as he or she: 1. was not going to live in the property; 2. was not intending to and did not incur any expenses of ownership of the property, including mortgage payments; 3. did not intend to or obtain rent in respect of your legal ownership; and 4. had no intention to benefit from any future sale of the property. Accordingly, the ATO considered that no CGT event happened when legal title was transferred by the parent to the child. COMMENT – this ruling is consistent with the ATO view that where there is only one beneficiary there can be ‘absolute entitlement’ so that the passing of property to such a beneficiary does not constitute a CGT event. ATO reference Private Binding Ruling Authorisation Number 1051895459052 w https://www.ato.gov.au/law/view/document?docid=EV/1051895459052

My opinion is that you have a better chance of success if you make the ruling look like it is the taxpayer applying, not a professional. I also believe that unless you client intends dying in that house, if the other sections quoted above do not work for you, then it is well worth the cost of you looking into this matter, considering the capital growth experienced in the area this house is.

If the trust argument doesn’t get up then I think we may have a problem. Maybe your client didn’t inherited the house at all. Her mother appears to be the primary beneficiary so she inherits it, check with the solicitor. Now as your client is further down the tree than her mother I don’t think she can be substituted as the beneficiary for tax purposes. There may well be a transfer between mother and daughter at market value creating a CGT liability for the mother but again not your problem and a good outcome for your client as market value and fully covered by her main residence exemption from day one ie the day it was transferred to her.

The reason I am going for the hold in bare trust approach rather than TD 1999/78 and ID 2005/216 is because there does not appear to be any agreement at the start to transfer title. Even if we try to say that is the case once the deed of family arrangement is entered into you still have to address the capital gain at market value up until then.

There you go probably now more questions than answers. I hope section 118-205 fits your clients circumstances.

Ask Ban Tacs

Ask Ban Tacs