Question

In 2014 February, me and my Mom bought a property for $579 000 (tenants in common 50% each) to live in (principal place of residence). I had moved to work overseas in 2009, and is still currently working overseas; the reason we bought in joint names is because My mom could not get bank loan as she does not have any income, so relied on my income overseas to get mortgage approval. I spend around 2-3 months each year in Australia for holiday (apart from last 2 years due to covid travel restrictions) but I believe this is not enough to make me a tax resident. We now want to sell the property before the end of the financial year and my mom will move in with my sister. We are both Australian citizens. The property is expected to sell for around $1 million.

My understanding is that as an foreign resident for tax purposes I would not be able to get a clearance certificate from ATO, so I assume the buyer will have to withhold 6.25% of the purchase price (not 12.5% as my mom will be able to get a clearance certificate). I would not get 50% capital gains discount either as a non resident. I am wondering if I could contribute to my superannuation to minimise my CGT. I worked in Australia for 2 years before moving overseas in 2009, so I have an Australian superannuation account. Since no contribution has been made by employer or by myself since 2010, does that mean I can contribute maximum $ 102 500 into my superannuation account for tax deduction? (roll over from 2018, $25000 x 3 + $27500)?

I also have a question unrelated to the above but very keen to find out the answer to: a real estate agent told me that if I sell an investment property and then use the proceeds to buy another investment property within the same financial year, then I don’t have to pay CGT, as I am changing an investment, not making a profit. Is this true or not?

Answer

You are right on just about everything with your first question.

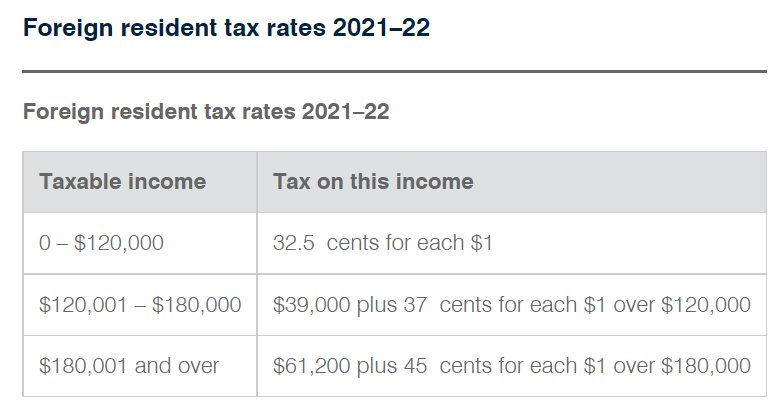

It sounds to me that you never lived in the place as a resident for tax purposes, which is such a shame. So as a non resident you are not entitled to the 50% CGT discount. Of course you are also not entitled to the tax free threshold so the 15% tax rate on super will look attractive. Note if your taxable income after adding back your super contributions is more than $250,000 then the tax rate on super is going to be 30%. I am hoping section 110-25(4) will help you stay under that, see further down. Here are the tax rates that will apply to the taxable part of the gain, that you can’t get into super.

Fortunately, if you already have a super fund in Australia you will be able to contribute to it and claim a tax deduction for up to $27,500. To go over that amount “catch up contributions” you have to also have a super balance of less than $500,000 at the end of the previous financial year. The saving of the unused cap began on 1st July 2018 so you should have available the 2019 cap of $25,000 the 2020 cap of $25,000 and the 2021 cap of $25,000. A total of $102,500 as you quite rightly calculated yourself.

The trick for you is section 110-25(4) which allows you to increase the cost base by all the costs of holding the property that were not otherwise claimed as a tax deduction. For example interest, rates, insurance, repairs and maintenance so even cleaning materials and lawn mowing.

Don’t worry about the amount of tax they withhold because you are a non resident, you are going to need to lodge a tax return anyway and it will either pay your CGT or come back to you.

As for rolling over into another investment property, that does not apply in Australia but I believe it does in the US.

Have you considered buying your Mum’s half instead? No sale no CGT and it gives you a foot hold in the Australian property market if you ever want to return.

Is there anyway you can prove that you really held the property in trust on behalf of your mother? Did you actually put any money into the house? Did you pay off the loan or did your mother? If you can show that it was in a bare trust for your mother then she would be able to cover it with her main residence exemption.

Ask Ban Tacs

Ask Ban Tacs