Question

I am an Australian citizen living in India Bangalore for the last 5 years for family reasons. I am 64 years old and ceased full time employment in July 2016. I bought a house on 29/4/2004 for $215000 as an investment property and rented it out and it was rented out throughout till I sold it on 30/1/2021, settlement effected 1/4/2021. I was living in rented accommodation while I was working in Australia. I was the sole owner of the property. The property was sold for $685000. There is a huge CGT liability which I would like to reduce.

My employers were paying super into Hostplus. My current balance is approximately $14000 as I have withdrawn some super over the years after reaching preservation age. My super balance at no stage over my working life exceeded $90000. I have never made personal contributions into my super.

Can I put in $25000 as a concessional personal contribution for the tax year 2020-21 to reduce my tax liability? I believe recent changes to the super rules allow previous years concessional contributions to be carried forward. How much more money can I put in?

Can you help with working out the reduced % in view of the May 2012 changes to the 50% CGT discount rule for non residents with the dates provided above? I left Australia on 16/7/2016 and have not been back since.

Can you work out the entire tax return for this financial year? I have been lodging online tax returns for previous years while I have been living in India for the rental income received.

Thanks

Answer

Yes you can put the $25,000 into super because you already have a superannuation account here. Though a fund can technically refuse contributions from a non resident, that is their option not the law. As a non resident for tax purposes you can’t open a super account but you can contribute to one that is already in existence. You are also entitled to use the carried forward of your unused caps. This started on 1st July 2018. As you have not contributed anything to super since then you have $75,000 you can contribute in the 2021 financial year. That is the amount you saved from the 2019 and 2020 year plus the allowance for 2021. Make sure you notify the fund that you will be claiming a tax deduction for the whole $75,000 before you go drawing any of it back out. As you are over 60 and not working you are entitled to draw it back out again, after the 15% contributions tax has been paid. So your tax would look a bit like this, there are of course finer points like depreciation write backs, selling and buying costs etc, to the calculating the capital gain.

| Sale Proceeds | $685,000 |

| Cost base say | $250,000 |

| Capital Gain | $435,000 |

| Less CGT disc | $152,250 (35%*) |

| $282,750 | |

| Plus net rent | $15,000 |

| Less Super Cont | $75,000 |

| Taxable Income | $192,750 |

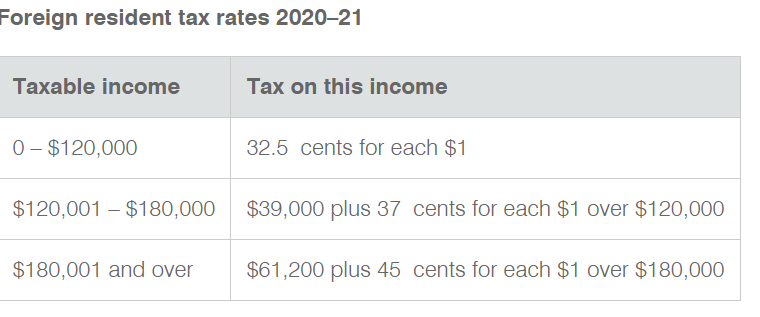

At non-resident tax rates, which means you will lose more than a 1/3rd of this in tax.

*You will not be entitled to the 50% CGT discount for the period of time you were a non-resident of Australia for tax purposes. There is an option to split the gain between before and after May 2012 (when the law came in) and then apportion. This might give a better outcome if there was a lot of capital gain before then. Otherwise, it is just a pro-rata calculation but on a per-day basis say you have owned the house for 17 years and have been overseas for 5 of those years. Then you only get 12/17ths of the 50% CGT discount which is 35%

For the sake of completeness, you can use your previous unused superannuation cap because your balance at 1st July 2020 was less than $500,000. BTW we do tax returns over zoom https://www.bantacs.com.au/virtual-tax-returns/

Ask Ban Tacs

Ask Ban Tacs