Question

Personal Background

We are planning to move to England this year. We live in a home in Victoria that we own (still have mortgage on it). It was our PPR for 12 months, then we used it as an occasional weekender and rented it out on other weekends. For the past 18 months we have lived there permanently as PPR. We built the property – bought the land, built the house and completed the home about 6 years ago. We are unsure how long we will remain in the UK. It may be 12 months or it may be forever – we’re open to possibilities.

My wife is from England, We have been in Australia 13 years and have since got married and now have built a family. We still have lots of friends and family in England and we’ve been back a dozen times in the past 13 years.

We had originally planned to keep our house, as a fall back in case England doesn’t work out longer term. We liked the idea of having somewhere familiar to return to if the UK wasn’t for us or the kids.

We were planning to rent out our property on the short term holiday let market. We have done this previously as mentioned above. But since then, due to increased interest rates (mortgage costs) and the reduction in likely bookings due to cost of living, we find ourselves in a position that we will have to be topping up our mortgage whilst in the UK to the tune of $3k – 4k per month – which will be a stretch and likely impact our enjoyment of the UK.

I am also very concerned about the CGT implications of selling whilst abroad. I only learnt this recently (after we made the decision to move) and its really concerning me. If the UK does work out and I want to buy a home in the UK I will need to sell my Australian home to help fund a UK purchase. As I understand it I will be liable for considerable CGT. Lastly, we are emotionally attached to the home, we’ve put a lot of effort into it and we love it but I wonder if the rational decision is to sell in order to make our future finances more viable.

Property Background

- Land purchase: $172,500

- Build price: $680,000

- Total = $852,500

We have had the property both valued for bank and appraised by agents at $1.5m

Questions

- Based on the above figures what will be my CGT liability – eg; how much tax will I have to pay – if I am abroad – assuming I and my wife earn no other income in Australia during the FY I sell the property?

- Am I liable to pay CGT in UK as well? If so, is this calculated on the total Capital Gain at sale or the Capital Gain after ATO has taken their slice?

- If I was to sell prior to moving, therefore avoiding CGT – do I need to be in the country when the property settles, or does a signed contract with deposit constitute ‘a sale’ and therefore I can leave for the UK at that point whilst settlement takes place?

- If I sell and settle the property whilst in Australia, but then swiftly move to the UK (but retain sale proceeds in Australian bank) can I assume the ATO doesn’t seek to recoup CGT after the sale even though I’ve moved abroad?

- The house ownership is in both my wife’s name and mine. Do we both need to be in Australia when the property settles to avoid CGT. Or could she be on ‘holiday’ in the UK with the kids whilst I’m in Australia and settlement takes place – she won’t be employed in UK.

- If we don’t sell before we go, but decide in 6 – 12 months that we need to, is there a way to avoid paying the CGT – eg, can we return to Australia for a month or two to sell the property and then move back, or do we need to be here longer (and working) etc?? Any suggestions on what actions we would need to take in order for us to avoid that CGT trigger?

Answer

This is such a classic Expat issue, such a hard choice to make. A crystal ball one, only you can guess what your family is most likely to choose. Yes, if you leave the country and take up tax residency in the UK you are going to lose your main residence exemption retrospectively. Whereas it looks like (assuming you were renting somewhere else yourselves when you rented this house out) if you sell now no CGT will be payable. The only thing I can do is help you calculate how much the CGT would be if you sell while living in the UK. I attach a spreadsheet that will help you do it right down to the detail. Note I have given you the main residence spreadsheet that does allow for some periods of time covered by the main residence exemption. The period of time for you would be zero, I have just chosen this spreadsheet because it gives consideration to holding costs while you are living there. Also consider legal costs and stamp duty to buy as well as selling costs. A key consideration for you is section 110-25(4) ITAA 1997 which will allow you to increase the cost base of a property by the holding costs that have not otherwise been claimed as a tax deduction. This would be the interest, rates, insurance, repairs and maintenance which includes things like cleaning materials and lawn mowing, while you were living there.

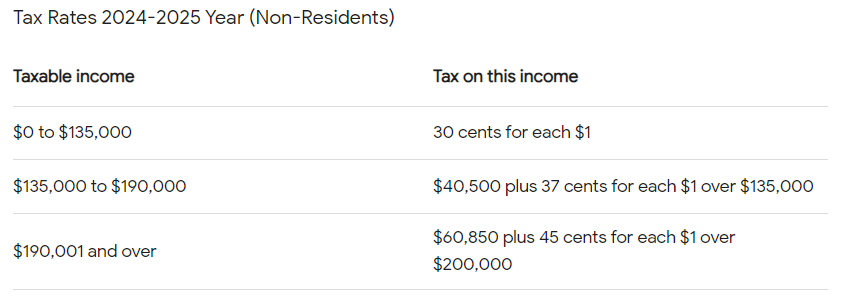

I have put the figures you have given me in the spreadsheet but would like you to work on them. You are not entitled to the 50% CGT discount for the time you are a non resident of Australia for tax purposes. This is a pro rata calculation so if you own the property for 10 years and two of those years you are a non resident for tax purposes then you only get 80% of the 50% CGT discount, that is 40%. The tax rate will be non resident tax rates, no tax free threshold. On the upside your UK income will not push you into a higher tax bracket. You also will not have to pay the 2% Medicare levy. You can make contributions to a super fund here and claim that as a tax deduction to reduce the after discount capital gain but get advice about the contribution caps. Here are the non resident tax rates:

Questions

1. Based on the above figures what will be my CGT liability – eg; how much tax will I have to pay – if I am abroad – assuming I and my wife earn no other income in Australia during the FY I sell the property?

There are many variations, the spreadsheet has an estimator in it. Do some what if on how much discount you are likely to get and put in the buying, selling and holding costs. At the moment it looks like the tax on the gain may be less than $100,000. Still a lot and you may want to redirect what you can into super to negate this. But even at $100,000 consider the selling costs you are going to incur and the buying costs when you return and it might be worth it, again only you can guess which country your family it going to prefer. I think it may all boil down to not being able to afford to hold the property while you are living overseas anyway. But as they say, crunch the numbers.

2. Am I liable to pay CGT in UK aswell? If so, is this calculated on the total Capital Gain at sale or the Capital Gain after ATO has taken their slice?

I can’t tell you what the UK tax law says but if the roles were reversed yes you would have to though only on the capital growth since you changed residency. Note our double tax agreement compels the UK to give you a tax credit for the tax paid in Australia.

3. If I was to sell prior to moving, therefore avoiding CGT – do I need to be in the country when the property settles, or does a signed contract with deposit constitute ‘a sale’ and therefore I can leave for the UK at that point whilst settlement takes place?

It is based on CGT event so when the contract is signed reference 118-110(3) and 104-10 ITAA 1997. But I would not risk it, if the contract falls through then you are in the worst of both worlds.

4. If I sell and settle the property whilst in Australia, but then swiftly move to the UK (but retain sale proceeds in Australian bank) can I assume the ATO doesn’t seek to recoup CGT after the sale even though I’ve moved abroad?

Only if there was CGT under normal residency tax considerations. Note you will need to provide the buyer with a certificate of residency from the ATO, so do this before you leave.

5. The house ownership is in both my wife’s name and mine. Do we both need to be in Australia when the property settles to avoid CGT. Or could she be on ‘holiday’ in the UK with the kids whilst I’m in Australia and settlement takes place – she won’t be employed in UK.

You become a resident of the UK for tax purposes when you arrive in the country with the intention of staying. So to retain her residency of Australia while actually living there she would need a change of circumstances that led to her staying.

6. If we don’t sell before we go, but decide in 6 – 12 months that we need to, is there a way to avoid paying the CGT – eg, can we return to Australia for a month or two to sell the property and then move back, or do we need to be here longer (and working) etc??

You have to become a resident for tax purposes again, that is re establish yourself in Australia ie get a job and enrol children in school etc

Any suggestions on what actions we would need to take in order for us to avoid that CGT trigger?

Divorce in less than 6 years of leaving the country. Terminal illness and death within 6 years also avoid the trigger.

Note the spreadsheet referred to is this one https://www.bantacs.com.au/shop-2/protecting-your-home-from-cgt/ but you will have to make adjustments to the rate of the 50% CGT Discount in the estimator. Also in the estimator put in 1 day not covered by the main residence exemption and 1 day total ownership period so it does not pull out a period of time that the property is exempt from CGT.

Ask Ban Tacs

Ask Ban Tacs