Borrowing From The Bank and On Lending to Your Company or Trust

Question Wife borrows against her investment property to lend to husband’s company with a formal loan agreement. Company directly pays the interest on the increased (split) portion of the loan. Should wife account for both the income (repayments) and interest in her tax return or is this some “domestic arrangement” with no tax implications for …

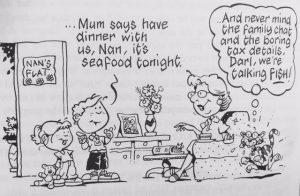

Ask Ban Tacs

Ask Ban Tacs